In my journey as a trader, I have explored various charting techniques, but one that stands out is the Renko chart. This unique indicator simplifies the trading process by focusing on price movement rather than time. In this comprehensive tutorial, I will share my insights on trading with the Renko chart indicator, including its construction, advantages, and practical applications.

What is a Renko Chart?

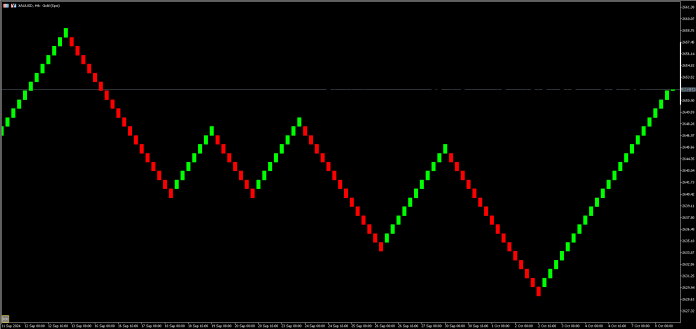

Renko charts are a type of price chart that originated in Japan. Unlike traditional charts that use time intervals, Renko charts focus solely on price movements. Each “brick” on a Renko chart represents a specific price movement, which can help traders identify trends and reversals without the noise of time-based fluctuations.

How Renko Charts are Constructed

A Renko chart is built using a fixed price movement, often referred to as the “brick size.” Here’s how it works:

- Setting the Brick Size: The first step in constructing a Renko chart is determining the brick size. This can be a fixed value, such as 5 pips or a percentage of the price. The choice of brick size will affect the sensitivity of the chart to price movements.

- Drawing Bricks: When the price moves up by the specified brick size, a new brick is added above the previous one. Conversely, when the price moves down by the same amount, a new brick is created below the last one. Importantly, Renko bricks are not drawn based on time; they are drawn as price moves.

- No Time Axis: Unlike candlestick charts, Renko charts do not have a time axis. This means that the timeframe for each brick can vary based on market volatility.

Advantages of Using Renko Charts

There are several advantages to using Renko charts in trading:

1. Noise Reduction

One of the most significant benefits of Renko charts is their ability to filter out market noise. By focusing solely on price movements, Renko charts provide a clearer picture of market trends, making it easier to identify entry and exit points.

2. Trend Identification

Renko charts excel at identifying trends. When a series of bricks is formed in one direction, it indicates a strong trend. This allows traders to make more informed decisions about when to enter or exit a trade.

3. Simplicity

The simplicity of Renko charts is appealing. As a trader, I appreciate the straightforward approach, which allows me to focus on price action without getting distracted by time-based fluctuations.

4. Flexibility

Renko charts can be used in various trading strategies, from scalping to swing trading. Their adaptability makes them suitable for traders with different styles and objectives.

How to Trade with Renko Charts

Step 1: Setting Up the Renko Chart

Before diving into trading, I recommend setting up the Renko chart on your trading platform. Most platforms, such as MetaTrader, TradingView, and NinjaTrader, offer Renko chart options. Here’s how to set it up:

- Open your trading platform.

- Select the asset you wish to trade.

- Choose the Renko chart type from the chart options.

- Set your desired brick size based on your trading strategy.

Step 2: Analyzing the Chart

Once the Renko chart is set up, I analyze it for potential trading opportunities. Here are a few key elements to consider:

Trend Analysis

Look for consecutive bricks in the same color (either green for bullish or red for bearish) to identify trends. A series of green bricks indicates a bullish trend, while a series of red bricks signals a bearish trend.

Support and Resistance Levels

I also pay close attention to support and resistance levels. These levels can be identified by observing where price has previously reversed or consolidated. In Renko charts, these areas may correspond to the flat sections of bricks.

Step 3: Entry and Exit Strategies

With the analysis in hand, I develop entry and exit strategies based on Renko chart patterns.

Entry Points

- Trend Following: I often enter a trade in the direction of the trend when a new brick is formed in the same color as the previous series. For example, in a bullish trend, I would enter a long position when a new green brick appears after a series of green bricks.

- Reversal Patterns: Renko charts can also help identify reversal patterns. For instance, if there are three consecutive red bricks followed by a green brick, it may signal a potential reversal, prompting me to consider a long position.

Exit Points

- Trailing Stops: To secure profits, I often use a trailing stop strategy. This involves moving my stop-loss order to follow the price as it moves in my favor, allowing me to capture more significant gains.

- Set Targets: I also set profit targets based on previous support and resistance levels or Fibonacci retracement levels. This helps in making informed decisions about when to exit a trade.

Common Mistakes to Avoid

While trading with Renko charts can be straightforward, there are common mistakes that I have learned to avoid:

1. Ignoring Market Context

It’s essential to consider overall market conditions. Relying solely on Renko charts without analyzing fundamental factors or broader market trends can lead to poor trading decisions.

2. Inappropriate Brick Size

Choosing the wrong brick size can significantly impact the effectiveness of Renko charts. A brick size that is too large may miss important price movements, while one that is too small may create excessive noise.

3. Overtrading

The simplicity of Renko charts can sometimes lead to overtrading. I remind myself to be patient and only execute trades that meet my criteria, rather than jumping into every opportunity that appears.

Tools and Resources for Renko Trading

To enhance my trading experience with Renko charts, I utilize various tools and resources:

Trading Platforms

- MetaTrader: A popular choice among forex traders, MetaTrader allows for easy access to Renko charts.

- TradingView: This platform offers advanced charting tools and a user-friendly interface for analyzing Renko charts.

Educational Resources

- Books: I recommend “Japanese Candlestick Charting Techniques” by Steve Nison for a deeper understanding of charting techniques, including Renko charts.

- Online Courses: Websites like Udemy and Coursera offer courses focused on technical analysis and trading strategies that include Renko chart insights.

Conclusion

In conclusion, trading with Renko charts has significantly impacted my trading approach. Their ability to filter out noise, identify trends, and provide clarity in price action makes them a valuable tool for any trader. By following the steps outlined in this tutorial, I believe you can effectively incorporate Renko charts into your trading strategy.

Remember, successful trading requires practice, so take the time to familiarize yourself with Renko charts and develop your unique trading style. Happy trading!

.jpg?w=100&resize=100,70&ssl=1)